The board and current supervisory board of Gartenbau-Versicherung. Newly elected to the supervisory board: Monika Köstlin (third from right).

Localized damage events, few major losses and a growing international business contribute to a stable annual result. At the same time, strategic risk diversification was further strengthened. At this year’s general assembly of member representatives, board members Christian Senft and Dr. Dietmar Kohlruss expressed satisfaction with the past fiscal year.

Positive Claims Performance in Direct Business

Claims payments in the direct business amounted to €41.4 million. The gross loss ratio in this segment stood at 46.0%, reflecting the moderate claims development. Regionally limited weather-related damages led to a greater proportion of technical losses, such as power outages in German and Dutch operations and isolated fire and explosion incidents in France. In contrast, indirect business experienced exceptionally high claims expenses, which influenced the overall gross loss ratio of 71.8% (previous year: 79.7%).

Internationalization Shows Results

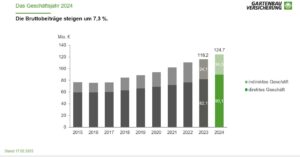

The strategic expansion of international direct business is paying off: in 2024, its share slightly exceeded 50% for the first time. Premium growth was achieved in Italy, France, the Netherlands, Switzerland, and the new markets of Greece and Poland. As a result, gross premiums in the overall business rose to €124.7 million (previous year: €116.2 million). Chairman of the Board Christian Senft emphasizes: “Our increasing presence in international markets is not an end in itself – it strengthens our resilience and ensures long-term stability for our members in Germany as well. By diversifying risks and tapping into new potential, we create the foundation to remain a reliable partner for all our members in the future.”

Solid Result, Strengthened Equity

The result from ordinary business activity before taxes was €2.5 million. Investments in IT had a negative impact. Nevertheless, the net income after taxes amounted to €3.0 million. Equity increased by 7.4% compared to the previous year, reaching €43.6 million. “The developments over the past fiscal year confirm the resilience of our business model,” says CFO Dr. Dietmar Kohlruss. “Despite higher claims expenses in the indirect business, we achieved a positive underwriting result and a moderate annual surplus.”

Risk Management Remains a Core Task

In terms of products and pricing, the most significant change in the past fiscal year was the introduction of a new premium system with risk levels in Italy. This adjustment responds to the high claims in recent years while maintaining insurability for Italian members. “Robust reinsurance protection and professional risk management are fundamental pillars of our business model,” emphasizes Christian Senft. “Only through consistent risk analysis, prevention, and investment in strategic partnerships can we meet growing challenges—and act in the best interest of our members.” In line with this, the mutual insurance association signed a contract in 2024 for a strategic investment in wirfliegendrohne.de GmbH, aiming to offer a variety of services to members.

At their annual assembly, the member representatives discharged the board and supervisory board and made decisions on key corporate policy issues.

New Members on the Committees

In the scheduled elections, supervisory board members Frank Werner and Jens Schachtschneider were re-elected. Monika Köstlin was newly elected to the supervisory board. Monika Köstlin is Chairwoman of the Board of the Kiel Reinsurance Association a.G. in Kiel and a board member of the Association of Mutual Insurance Companies e.V. in Kiel. She is well-acquainted with Gartenbau-Versicherung’s business model and will be a significant asset to the supervisory board. She succeeds Ute Martin, who stepped down after an impressive 33 years. Together with her husband, Ute Martin runs an ornamental plant and outdoor vegetable business in Zwenkau, which they took over from family ownership in 1992. That same year, she joined Gartenbau-Versicherung’s supervisory board and has since shaped it as one of its longstanding female voices. At the conclusion of her term, Ute Martin expressed her delight that Monika Köstlin, a woman with a strong insurance background, will be her successor. Supervisory board chairman Frank Werner expressed special appreciation for Martin’s outstanding commitment and more than three decades of dedicated service.

The board and current supervisory board of Gartenbau-Versicherung. Newly elected to the supervisory board: Monika Köstlin (third from right).

The terms of numerous member representatives were also renewed by the 40-member assembly. Newly elected member representatives include ornamental plant grower Sebastian Klein, garden center owner Matthias Großkopf, rose specialist Kati Bräutigam, business successor Mathias Scheffler, and tree nursery owner Richard Messerle. Supervisory board chairman Frank Werner thanked all departing representatives for their trustful cooperation. CEO Christian Senft personally thanked Heinz Markl, who did not run again after 27 years and was honored with a badge of distinction for his long service.

Supervisory board chairman Frank Werner with the newly elected and re-elected member representatives. Left to right: Dieter Schweizer, Mathias Scheffler, Sebastian Klein, Frank Werner, Willy Enßlin, Matthias Großkopf, and re-elected Klaus Schürg.

We are there for you.

Our insurance solutions are characterized by their modular structure.

This allows us to offer you comprehensive insurance cover that is individually tailored to your business.

Find out more now at https://Gartenbau-Versicherung.de/sicherheit/ or contact your local risk consultant.